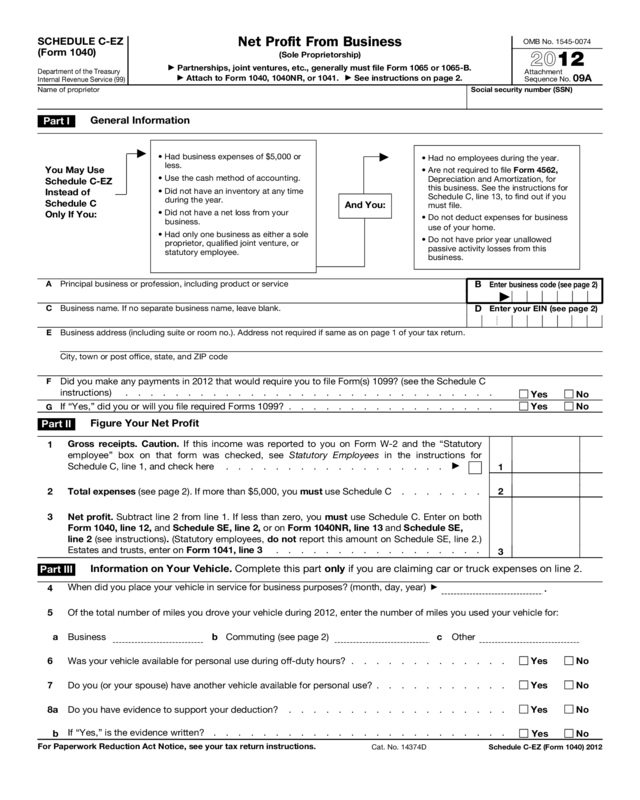

What is Tax Form 1040 Schedule E and How is It Related to Investing?įorm 1040 Schedule E is a tax form the IRS requires individuals to file with their annual tax return if they received any supplemental income throughout the year.

If you invest in rental real estate, it’s likely you’ll need to file Schedule E with your tax return.In this article, you’ll learn what the Schedule E form is and when you might need to file it as part of your annual tax return. Certain types of income - considered supplemental income by the IRS - are filed on Form 1040 Schedule E. But the form you use to report that income may differ depending on how and where you earned it. We may receive compensation when you click on links to those products or servicesĮach year, the IRS requires individuals to report and pay taxes on income they earned.

Advertising Disclosure This article/post contains references to products or services from one or more of our advertisers or partners.

0 kommentar(er)

0 kommentar(er)